Advantages and Disadvantages of Filing Bankruptcy in Ohio

Filing for bankruptcy is your legal right if you can no longer afford your debts. But while bankruptcy is often the first step toward renewed financial health for many Ohio residents, there is a downside to filing for bankruptcy.

If you cannot pay your bills and are considering bankruptcy in Ohio, an experienced Ohio bankruptcy attorney can help you explore whether this is your best option for resolving your debts and financial difficulties.

In this article, we at Amourgis & Associates, Attorneys at Law, discuss the pros and cons of bankruptcy. Contact us today for a free initial consultation to discuss how we can assist you in resolving your debts and financial difficulties.

What Is Bankruptcy?

Bankruptcy is a legal process provided by federal law that allows individuals or businesses that cannot repay their debts to seek legal relief from creditors. The objective of a bankruptcy is to provide the debtor with a fresh financial start by relieving them of certain debts. People struggling with medical bills, credit card debt, tax debts, car loans, and other personal loans may find debt relief with bankruptcy.

Bankruptcy is a complex process that requires filing a petition with the Bankruptcy Court detailing your assets and liabilities and submitting to the directions of a Court-appointed trustee who manages the case.

The most common types of bankruptcy are filed under and named for Chapter 7 and Chapter 13 of the U.S. Bankruptcy Code.

In a Chapter 7 bankruptcy, the trustee sells some of the debtor’s assets to raise funds, which are then distributed among eligible creditors. Chapter 7 is commonly referred to as a “liquidation” bankruptcy.

In a Chapter 13 bankruptcy, the debtor submits a plan to repay their debts over three to five years, which the assigned trustee must approve. A Chapter 13 bankruptcy is known as a “reorganization” and is sometimes referred to as a “wage earner’s plan.”

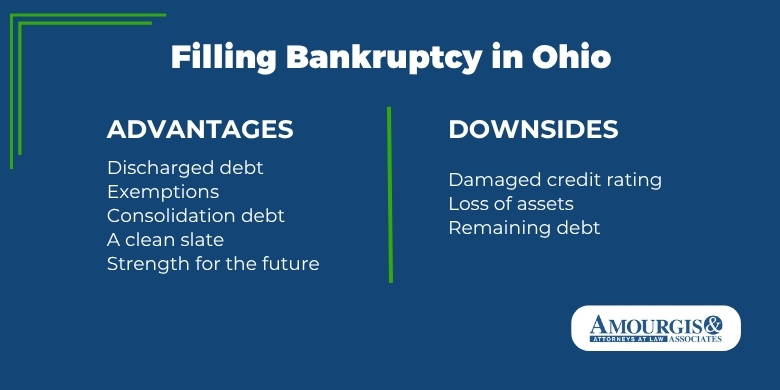

Advantages of Filing Bankruptcy

One of the biggest advantages of filing bankruptcy is simple: it stops your creditors from harassing you! An immediate and often welcomed benefit of filing for bankruptcy is the end of all contact from creditors. Once you have filed for bankruptcy, it is illegal for creditors to pursue payment or other actions against you, such as lawsuits, foreclosure, repossession, or wage garnishment.

Some of the other “pros” of bankruptcy include the following:

- Discharged Debt – At the conclusion of a bankruptcy filing, certain eligible debts are discharged, which means they are forgiven. Other debts may be partially discharged, allowing you to pay them off for less than you previously owed.

- Exemptions – Certain assets you own are exempted from seizure, including in a Chapter 7 liquidation bankruptcy. Ohio bankruptcy exemptions can protect your home, motor vehicle, clothes, household goods, retirement savings, and more during bankruptcy proceedings.

- Consolidated Debt – In a Chapter 13 bankruptcy, you can repay creditors with a single payment each month or every other week to the bankruptcy trustee, who distributes it among your creditors. In Chapter 7, the trustee handles the sale of assets and distribution of proceeds to creditors.

- A Clean Slate – At the conclusion of the bankruptcy process, you emerge with no debt and with creditors required to tell credit reporting agencies that you have zero balances on your accounts. Even back taxes that are more than three years old can be discharged. This gives you a fresh start to rebuild your financial standing and position yourself to take out loans and/or credit again in the future.

- Strength for the Future – You’ll emerge from bankruptcy better equipped to manage your finances, thanks to mandatory counseling. First, you must complete credit counseling within 180 days of filing your bankruptcy petition. Second, during your bankruptcy, you must complete a more detailed credit counseling/debt education course. These short but information-packed classes are designed to give you realistic and helpful advice for planning and managing your finances as you move forward.

Downsides of Filing for Bankruptcy

So, how does filing for bankruptcy hurt you? It’s hard to escape the fact that there are some downsides. When considering bankruptcy, it is essential to discuss the pros and cons of filing with an experienced bankruptcy lawyer who has reviewed your finances, debts, and goals to help you better manage your finances.

Some of the disadvantages of a bankruptcy filing include the following:

- Damaged Credit Rating – It’s likely that your credit score is already suffering from the impact of the debt that has you considering bankruptcy, and filing a bankruptcy petition will inevitably make it worse. Fortunately, this is temporary. At the conclusion of your case, bankruptcy will remain on your credit report for seven to 10 years, but your credit score will start to rise as you take steps to rebuild your credit. In some cases, our bankruptcy lawyers can project how soon and how much your credit score will improve. This can help you plan for your brighter future.

- Loss of Assets – Particularly in a Chapter 7 bankruptcy, you will have to turn over some of your belongings to be sold. But, instead of just submitting to the bankruptcy trustee, you have the right to protect certain property and financial holdings under Ohio’s bankruptcy exemptions. Our bankruptcy attorneys can mitigate your loss by helping you determine the most advantageous application of the exemptions you qualify for.

- Remaining Debt – Bankruptcy does not eliminate all of your debts. Student loans, unpaid alimony and child support, and most back taxes are not discharged in bankruptcy. You’ll still have these payments ahead of you, and they’ll be accounted for in your consolidated debt payments.

Filing Bankruptcy in Ohio – What You Need to Know

If you are dealing with debts that you can no longer afford and there’s no reason to expect your situation to change, the prospect of bankruptcy is something you should consider. Bankruptcy is your right if your situation calls for it, and you are not alone.

More than 10,000 individuals and businesses file for bankruptcy in Ohio every year, and this figure can double during tough economic times.

An Ohio bankruptcy attorney from Amourgis & Associates, Attorneys at Law, can help you by first exploring alternatives to bankruptcy. We may be able to help solve your problems by negotiating loan modification and/or debt consolidation agreements that you can afford.

If together we determine that bankruptcy best suits your financial circumstances, we’ll guide you as we decide what types of you qualify for and which will provide the most effective and efficient relief. We’ll make sure everything about your bankruptcy is handled correctly and smoothly, and we’ll advocate aggressively for your interests before the bankruptcy trustee, the Court, and in response to any objections from your creditors.

Contact Our Ohio Bankruptcy Attorneys for More Information

If you’re overwhelmed with debt, bankruptcy may be the answer to having your debts discharged. Instead of continuing to struggle and worry, find out what the way out of your financial problems looks like. Contact the experienced Ohio bankruptcy attorneys of Amourgis & Associates, Attorneys at Law, for a free and confidential assessment of your financial situation and the best way forward.

Call or reach out online today to get started on a plan for a life free from the burden of unmanageable debt.