Cleveland Foreclosure Defense Lawyer

If you’ve received notice of a potential foreclosure of your home, your first thought may be to ask, “How do I find a foreclosure attorney near me?” Experienced legal counsel can help you seek to stop foreclosure and keep your home. Contact Amourgis & Associates, Attorneys at Law, for a free initial case evaluation to discuss your options for protecting what you’ve worked so hard to achieve.

What is Foreclosure, and How Does It Affect Homeowners in Cleveland?

When a person buys residential property via a mortgage loan, the mortgage makes the property a form of collateral for the loan. After the homeowner defaults on their loan payments, the mortgage company can use the home to recover repayment via foreclosure. In foreclosure, a mortgage lender can obtain a court order for an auction to sell a homeowner’s property after the homeowner has defaulted on their mortgage.

When the sale sells the property for more than the homeowner owes on their mortgage, the sale proceeds will pay the mortgage lender, and the homeowner will receive any remaining balance. However, suppose the property sells for less than what is owed on the mortgage after the mortgage lender submits the highest bid at the sale. In that case, the lender may pursue a deficiency action against the homeowner to recover the balance remaining on the mortgage loan after deducting the sale proceeds.

Foreclosure can have devastating financial and personal consequences for homeowners. First, foreclosure can cause considerable stress and anxiety as homeowners face the prospect of losing their homes. When a foreclosure case results in an auction sale, and the court confirms the sale, the homeowner must vacate the house or face an eviction proceeding. Although a homeowner may recover some of the equity they’ve built in their home if it sells for more than they owe on the mortgage, a foreclosure may result in the homeowner continuing to owe money to the lender if they place the highest bid for less than the balance of the mortgage.

Why You Need a Foreclosure Attorney Near Me in Cleveland

Even after falling behind on mortgage payments, you may have options for avoiding or stopping foreclosure to keep your home. An experienced Cleveland foreclosure attorney can walk you through the available strategies based on the facts and circumstances in your case. Hiring legal representation can help by:

- Having a knowledgeable attorney who can investigate your case and obtain evidence that may help you form defense strategies to help during foreclosure proceedings

- Walking you through your legal options to help you make informed decisions about how to proceed in your case

- Assisting you with pursuing alternatives to foreclosure, such as loss mitigation applications that may help you obtain a more affordable mortgage payment

- Representing you during settlement negotiations or mediation to help you obtain a favorable resolution

- Advocating your case in court, if necessary, to fight for your right to stay in your home

The Foreclosure Process in Cleveland, Ohio

After a homeowner has fallen behind on their mortgage payments, the mortgage lender or servicer will send a notice of default to the homeowner advising them of the lender’s intent to pursue foreclosure if the homeowner does not cure their default and informing the homeowner of their loan modification/loss mitigation options. Once adequate time has passed for the homeowner to cure their default or submit a loss mitigation application, or after the mortgage lender/servicer rejects the homeowner’s application, the lender/servicer may begin foreclosure proceedings.

The first step in foreclosure occurs when a mortgage lender or servicer files a foreclosure lawsuit in court. The complaint must allege how the homeowner has defaulted on their loan, the lender’s right to foreclose by possessing the note, the original mortgage, or an assignment of the mortgage, and the balance due on the mortgage loan. The lender must serve a copy of the complaint and a summons (which advises the homeowner of how, where, and when they must respond to the complaint and other important information, such as court-supervised mediation options). After receiving service of the complaint and summons, the homeowner may file an answer denying specific allegations or highlighting procedural deficiencies in the mortgage lender’s complaint or service of process. A homeowner has 28 days to file an answer, although they can ask the court to extend this deadline.

When a homeowner fails to file an answer, the lender can request a default judgment to proceed to a foreclosure sale. However, a homeowner who files an answer can pursue further litigation of the foreclosure case. Often, a mortgage lender will file a motion for summary judgment, arguing that the homeowner’s answer fails to raise any genuine dispute of material fact. If the court agrees, it can grant the lender’s motion and enter a judgment of foreclosure. When a homeowner raises a genuine issue of material fact, the court will hold a trial to resolve those issues.

When the court enters judgment for the mortgage lender upon a motion for default judgment or summary judgment or after trial, the court will order the property sold at auction. Before the auction, the court will order an appraisal of the property since it cannot sell for less than two-thirds of its appraised value. At the foreclosure sale, the mortgage lender can make a “credit bid” up to the total amount owed on the mortgage. Third parties can also submit bids. When the lender makes the highest bid but bids less than what is owed on the mortgage, it can pursue a deficiency judgment against the homeowner. Conversely, if a third party makes the highest bid, the court will confirm the sale and issue a writ of possession to the buyer unless the homeowner redeems the property first.

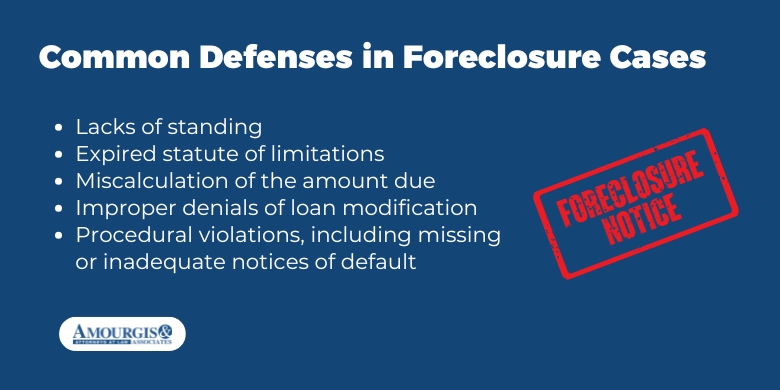

Common Defense Strategies in Foreclosure Cases

Homeowners may pursue various defense strategies in court to stop a foreclosure sale of their home. Although successful defenses against foreclosure require specific sets of facts, examples of strategies you might pursue in a foreclosure case in Cleveland include:

- The party pursuing foreclosure lacks standing because it does not possess the note or mortgage

- The applicable statute of limitations expired

- Miscalculation of the amount due, or you have already paid off the mortgage

- Improper denials of loan modification applications

- Procedural violations, including missing or inadequate notices of default or intent to foreclose

Legal strategies to prevent or temporarily stop foreclosure proceedings may also include filing for bankruptcy. The automatic bankruptcy stay prevents a mortgage lender or servicer from filing or continuing a foreclosure action. Bankruptcy can also provide an avenue to get current on your mortgage payments to keep your home.

Steps to Take When Facing Foreclosure in Cleveland, Ohio

Critical steps to take when you fall behind on your mortgage or receive a foreclosure notice include:

- Review the correspondence or notice from the mortgage lender/servicer to understand the alleged grounds for default and your options for resolving the default. You may find that the lender/servicer has made an error. Alternatively, you can pursue loan modification options if you can’t make your current mortgage payments.

- Gather documents relating to your mortgage, including copies of the loan documents, mortgage, and monthly statements.

- Keep in constant communication with the mortgage lender/servicer and pursue a loss mitigation application as soon as possible.

- Contact a foreclosure defense attorney promptly to discuss your options for resolving your mortgage default or preventing foreclosure of your home.

What to Expect During Your Consultation with a Foreclosure Attorney

During an initial consultation with a foreclosure attorney, you can expect to review various relevant documents in your case, including a copy of your mortgage, your mortgage statements, default notices from the mortgage lender/servicer, and paperwork for any loss mitigation applications you’ve filed. You and the attorney will discuss potential legal solutions you might pursue to stop the foreclosure of your home or obtain a favorable outcome to your case. The attorney will also allow you to ask questions to help you decide whether to hire the attorney for your case.

Choosing the Right Foreclosure Law Firm Near Me in Cleveland

When a foreclosure notice puts your home and finances at risk, choosing an experienced attorney can help you understand the legal process and fight for a positive outcome. Seeking to avoid foreclosure? Let the foreclosure law firm of Amourgis & Associates, Attorneys at Law, help you pursue a favorable resolution to your mortgage default and foreclosure case because:

- Our team can meet you at one of our conveniently located offices or via videoconference to make the process as easy as possible.

- Our attorneys will start on your case immediately and work diligently to pursue a favorable resolution for you. We utilize the latest technology to provide top-quality and responsive client service.

- We offer honest, straightforward advice to help you make an informed decision when facing tough choices.

- You can always contact our team to ask questions and discuss your case. We can communicate with you via phone, email, or text.

Protect Your Home with Trusted Foreclosure Attorneys in Cleveland

If you’ve fallen behind on your mortgage payments or received a foreclosure notice from the bank, you need experienced, dedicated legal counsel to protect your rights and interests. Contact Amourgis & Associates, Attorneys at Law, today for a free, confidential consultation with our Cleveland foreclosure attorneys. We’re ready to provide the advocacy and advice you need to protect your home and finances from the risk of foreclosure.