Bankruptcy Dismissal vs Discharge - What is the Difference?

Filing for bankruptcy in Ohio is a step toward regaining control of your finances. However, how your case ends significantly impacts your financial future. While many people confuse the terms “dismissal” and “discharge” in bankruptcy cases, these concepts are not identical.

In short, a bankruptcy discharge means your debts are wiped out, while a bankruptcy dismissal means your case is thrown out, and you still owe the debt. Make sure you understand dismissal vs discharge in Ohio bankruptcy cases and work with an experienced bankruptcy attorney to avoid an unpleasant outcome.

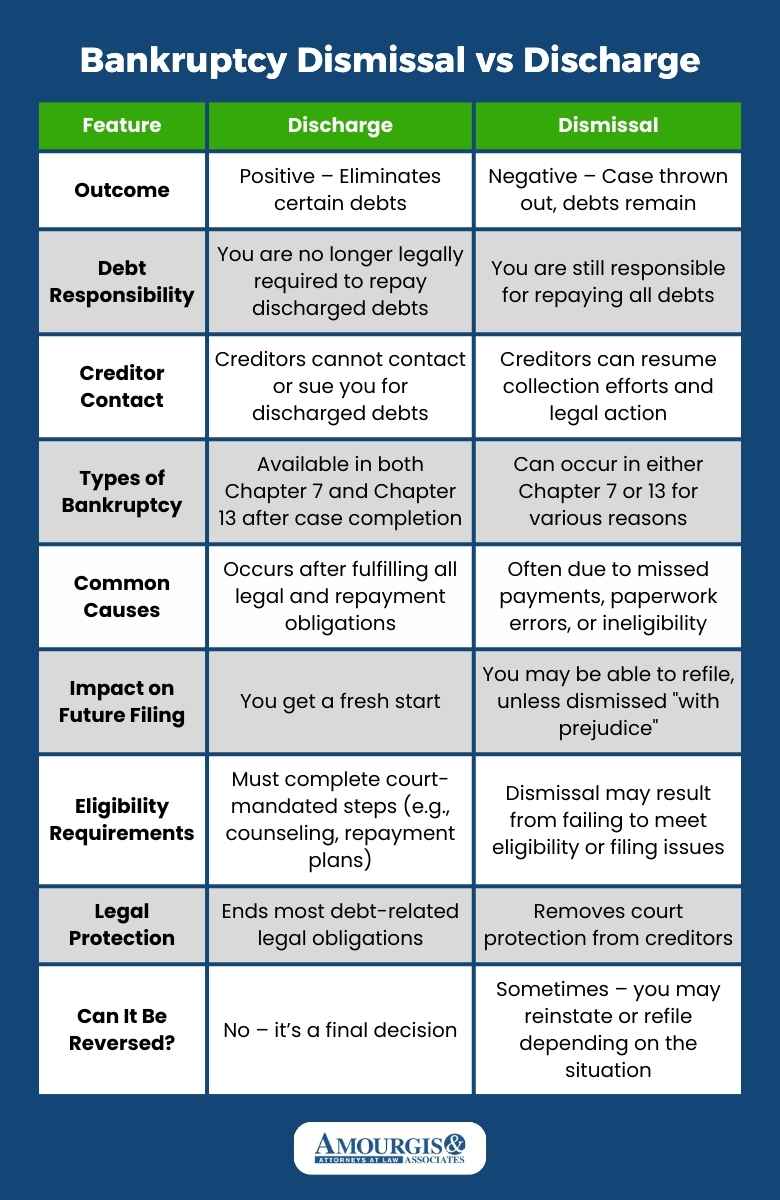

What’s the Difference Between Discharge and Dismissal?

The key differences between a bankruptcy discharge and a bankruptcy dismissal are as follows:

- Discharge – A bankruptcy court wipes out your eligible debt, meaning you no longer have to pay your creditors.

- Dismissal – The court closes your case without eliminating your debts, which means your creditors can resume collection efforts.

What Is a Bankruptcy Discharge?

A bankruptcy discharge is the final goal of a bankruptcy case. It’s a court order that permanently clears certain debts, freeing you from the legal obligation to repay them. Under Ohio bankruptcy law, a court may discharge your debts after you complete your Chapter 7 or Chapter 13 case. This means you’ve followed the rules for your type of bankruptcy, submitted the proper paperwork, and completed your repayment plan in Chapter 13 cases.

For Chapter 7, a discharge typically happens about three to six months after you file your initial petition. In Chapter 13, it comes at the end of your repayment plan, which usually takes three to five years. Once the court issues the discharge order, your creditors are legally barred from trying to collect those debts ever again. Some debts that are eligible for a discharge usually include credit card debt, medical bills, payday loans, personal loans, and late or unpaid utility payments.

However, some debts are not eligible for a discharge. These debts include student loans (except in rare cases), unpaid child support or alimony, and some tax debts. If a debt isn’t eligible for discharge, you’re still responsible for paying it after the case ends.

What Is a Bankruptcy Dismissal?

A bankruptcy dismissal happens when the court closes your case without granting a discharge. In other words, the court does not wipe out your debts, so you remain legally responsible for paying them. A dismissal can happen for several reasons, such as not submitting required paperwork, failing to attend required court hearings, or not keeping up with a Chapter 13 repayment plan.

When the court dismisses your case, the legal protection known as the “automatic stay” ends. That means creditors can start calling you again, send collection letters, file lawsuits, or even move forward with wage garnishments and foreclosures. Essentially, you lose the legal shield that bankruptcy provides.

Furthermore, a dismissal resets the entire bankruptcy process. If you still want help managing your debt, you’ll need to start over by refiling your bankruptcy petition. In many cases, you must go through a waiting period and meet additional court requirements before filing again.

What Happens After a Discharge vs. Dismissal?

Here’s what happens after a bankruptcy discharge vs. a dismissal in Ohio:

- After a Discharge – You no longer need to pay the discharged debts, and creditors cannot take any action to collect them. The discharge gives you a clean slate, allowing you to rebuild your finances, improve your credit over time, and move forward without the burden of overdue bills.

- After a Dismissal – The court closes your case without erasing your debts, which means creditors can resume collection efforts. Those efforts could include phone calls, lawsuits, wage garnishments, and foreclosures. You must redo the bankruptcy filing, and you may have to wait or meet additional legal requirements before doing so.

Why a Bankruptcy Case Might Be Dismissed in Ohio

While bankruptcy cases must follow the federal bankruptcy code, cases in Ohio must also follow specific local rules and filing requirements. Some reasons that an Ohio court might dismiss your bankruptcy case without a discharge include:

- Failure to Complete Credit Counseling – If you don’t finish a required credit counseling course before filing, the court may automatically dismiss your case.

- Missing or Incomplete Paperwork – Inaccurate schedules, missing financial disclosures, or failing to file required documents under Local Rule 1002-1 can lead the court to dismiss your case.

- Failure to Pay Filing Fees – If you don’t pay the filing fee or request a waiver or installment plan, the court may reject your case.

- Failure to Attend Required Hearings – Skipping your mandatory meeting with creditors or other court-mandated appearances can lead to a dismissal.

- Not Following Court Orders – Ignoring instructions or deadlines from the bankruptcy court, including local requirements for motions and notices, may cause the court to close your case.

- Falling Behind on Chapter 13 Payments – If you don’t keep up with your repayment plan, the trustee overseeing your case might request a dismissal.

Working with an experienced Ohio bankruptcy attorney can help you avoid these pitfalls and keep your case on track.

Can a Dismissed Bankruptcy Be Refiled in Ohio?

You can refile a dismissed bankruptcy case in Ohio, but only under certain conditions. The court might allow you to refile if you correct the issues leading to the dismissal, such as missing documents, unpaid fees, or missed hearings. In some cases, your lawyer may recommend refiling your case strategically, such as to fix errors in the original petition or change the type of bankruptcy. However, multiple filings can trigger legal restrictions, so it’s crucial to proceed carefully and work with an experienced Ohio bankruptcy attorney.

How to Increase Your Chances of a Discharge – Not a Dismissal

Here are a few tips for increasing your chances of achieving a discharge instead of a dismissal in your Ohio bankruptcy case:

- Complete your mandatory credit counseling course before filing

- Submit all required paperwork on time

- Pay the court fees on time, or apply for a fee waiver or payment plan

- Don’t miss your meeting with creditors and any other scheduled hearings

- Follow all court orders and local rules

- Work closely with your bankruptcy attorney

- Stay current on Chapter 13 plan payments, if applicable

Contact Our Experienced Ohio Bankruptcy Lawyers

The Ohio bankruptcy lawyers at Amourgis & Associates, Attorneys at Law, understand your desire for financial relief and can help you get the debt discharge you need. Call now or complete our contact form for a free consultation.